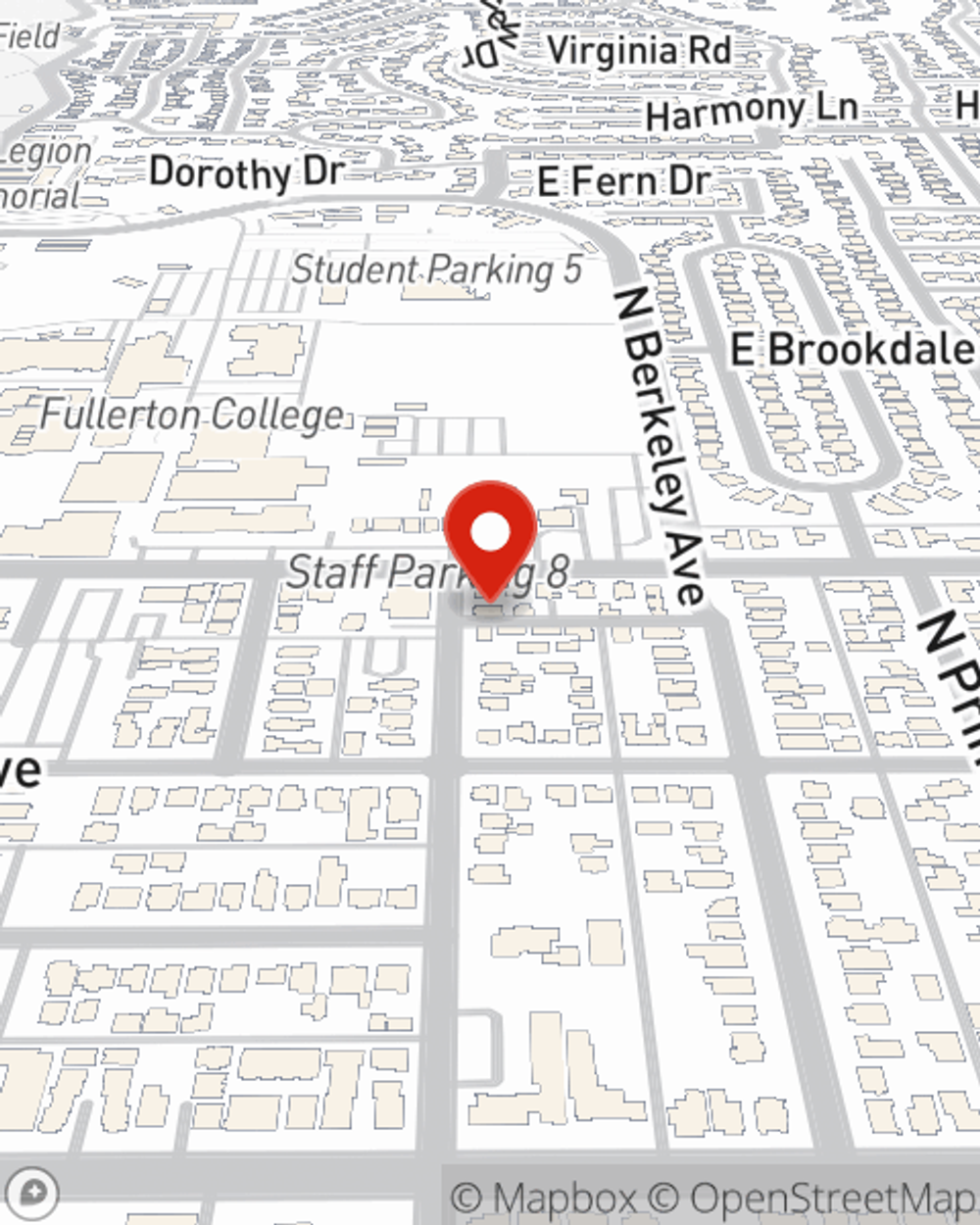

Homeowners Insurance in and around Fullerton

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- ALL OF CALIFORNIA

- ALL OF ARIZONA

Home Is Where Your Heart Is

You want your home to be a place of rest after a stressful day at work. That doesn't happen when you're worrying about laundry, and especially if your home isn't insured. That's why you need us at State Farm, so all you have to worry about is the first part.

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Agent Bill Sampson, At Your Service

Bill Sampson will help you feel right at home by getting you set up with dependable insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect precious items like your grandfather clock.

Don’t let worries about your home make you unsettled! Call or email State Farm Agent Bill Sampson today and learn more about the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Bill at (714) 869-3062 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Bill Sampson

State Farm® Insurance AgentSimple Insights®

Weatherproofing: how to prepare for a heat wave

Weatherproofing: how to prepare for a heat wave

As the summer approaches, it’s critical to consider how to prepare for extreme heat. We’ll discuss heat safety tips for your home and vehicle.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.